lower average cost stock calculator

Stock profit 12050 USD. You then buy another 100 shares at 30 per share which lowers your average price to 45 per share.

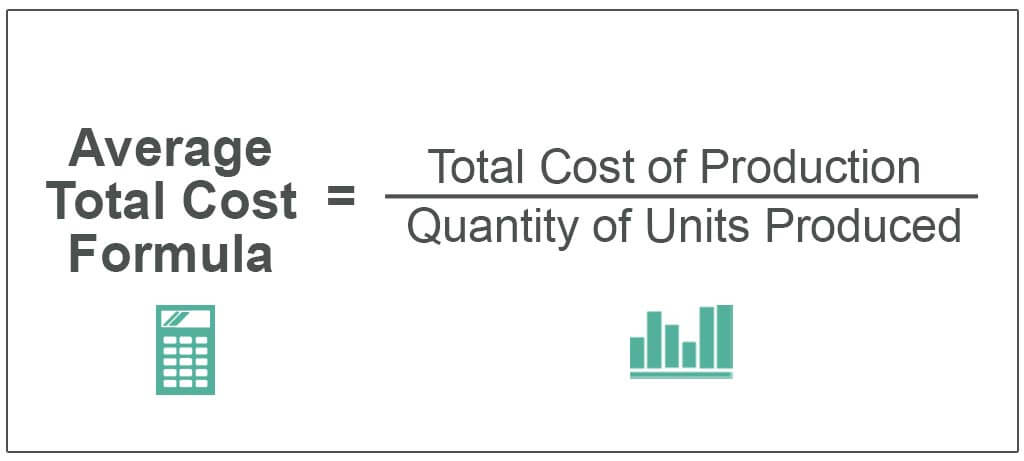

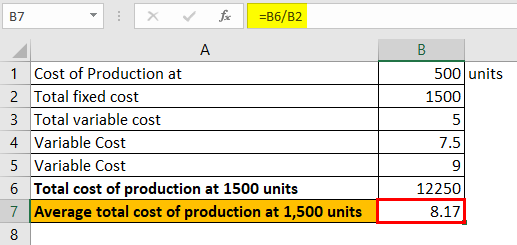

Average Total Cost Formula Step By Step Calculation

How much tax do I pay when I sell stock.

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

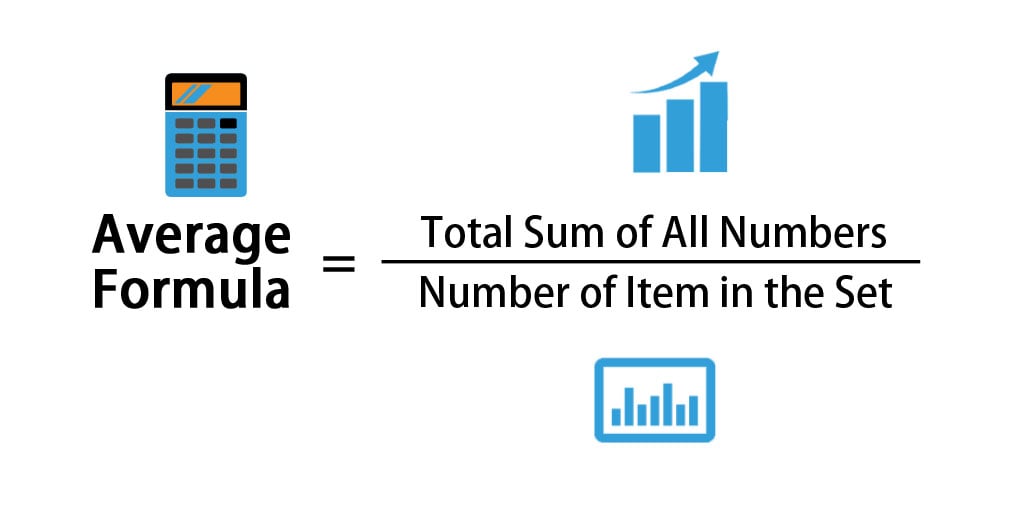

. In simpler terms it measures how much a business has to spend on each unit or product of output produced. Youll need to know your cost basis to determine when you. To calculate the average cost divide the total purchase amount 2750 by the number of shares purchased 5661 to figure the average cost per share 4858.

The COLFinancial Buy and Sell Calculator is for you. I want to buy 100 additional shares at 800 per share. How is stock price calculated.

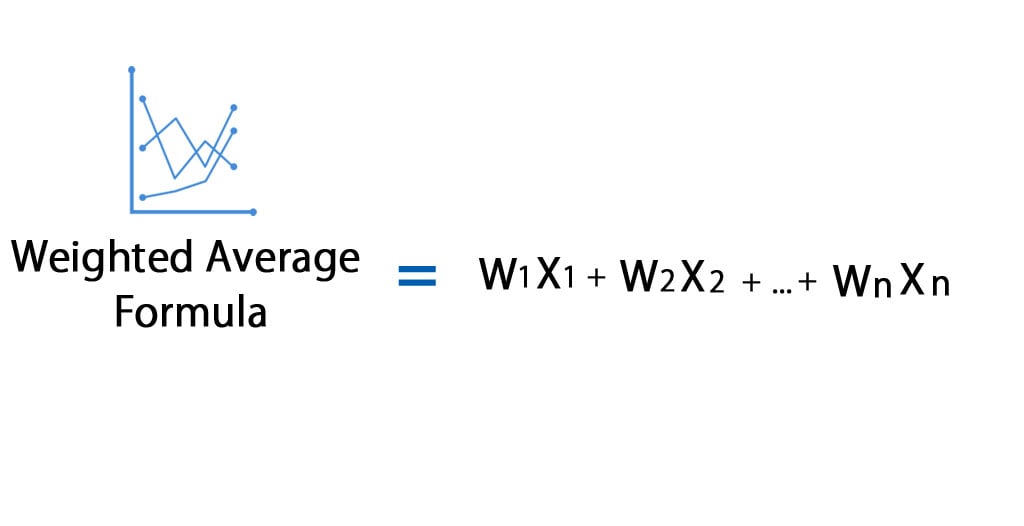

Cost Basis Average cost per share 4858 x of shares sold 5 24290. In cases where there is a series of prices it is helpful to calculate the average cost using the Average Down Calculator to reduce the range of prices to a single price. When investors or traders buy shares at different prices they want to know the average price and then investors decide that the stock is a profitable purchase.

The idea is that you will end up with an overall position of that stock at a lower price than if you simply held on to the initial trade. As the stocks price continues to fall and you continue to. The Stock Calculator is very simple to use.

Dollar-cost averaging is a strategy to reduce the impact of volatility by spreading out your stock or fund purchases over time so youre not buying shares at a. Backtest dollar-cost averaged investments one-month intervals for any stock exchange-traded fund ETF and mutual fund listed on a major US. Calculate your ROI by using the stock profitloss calculator to determine your percentage rate of return.

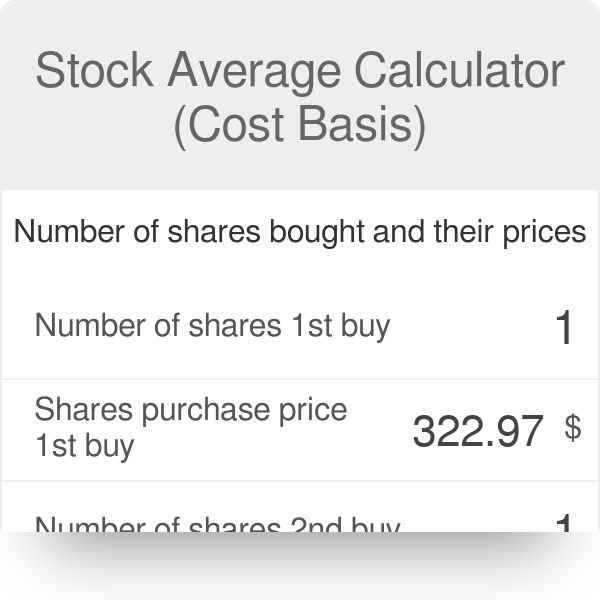

Indian stock market average calculator. Enter the number of shares and price per share for the first purchase and second purchase below. While thats not always the way it works the key point to understand is.

How to calculate the average price of the stock. Heres a simple illustration on how I reduced my losses by averaging down my average price per share. Which you did in last caliculation of yours.

Multiply the number of shares in each transaction by its purchase price. The calculator adds up all the trades in the stock and gives you the average price. If you have a hard time deciding when to sell.

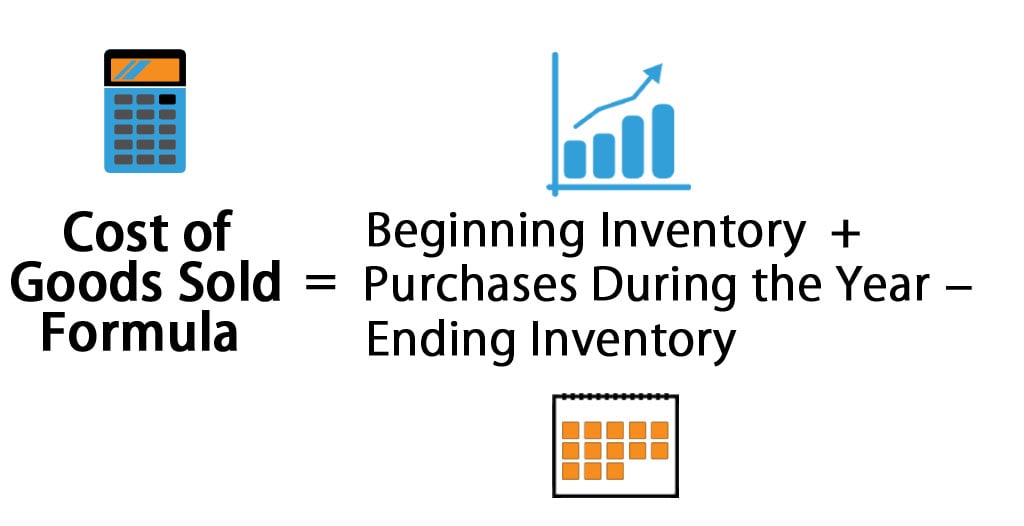

If I buy more shares at a lower price what is my new average cost per share Determine Average Share Cost when adding share to existing position. For example 1 when we have valued stock at a lower cost or a Market Price of 1000 the Gross Profit is 1500 whereas in example 2 when we have valued stock at a higher cost or a Market Price of 1200 the Gross Profit Gross Profit Gross Profit shows the earnings of the business entity from its core business activity ie. Add the amount of each purchase to calculate the total purchase price of the stock.

Your avarage price per stock is 2083. Read the article How To Calculate The Weighted Average Price to know how it is computed. The profit of the company that is arrived after.

If you have Android device you can find the average cost of your stock purchases with the average cost basis calculator which you can install for free. Your profit is 4 on 7 shares sold at the end of the day if we included sales in caliculation we reduce our price of next buy. This number is also known as average total cost or unit cost.

In this example calculate the sum. On your first day in the DRP AEs stock is at 25 and the plan allows you to invest a minimum of 25 through its optional cash purchase OCP program. As of now just visit this post every time you want to use the.

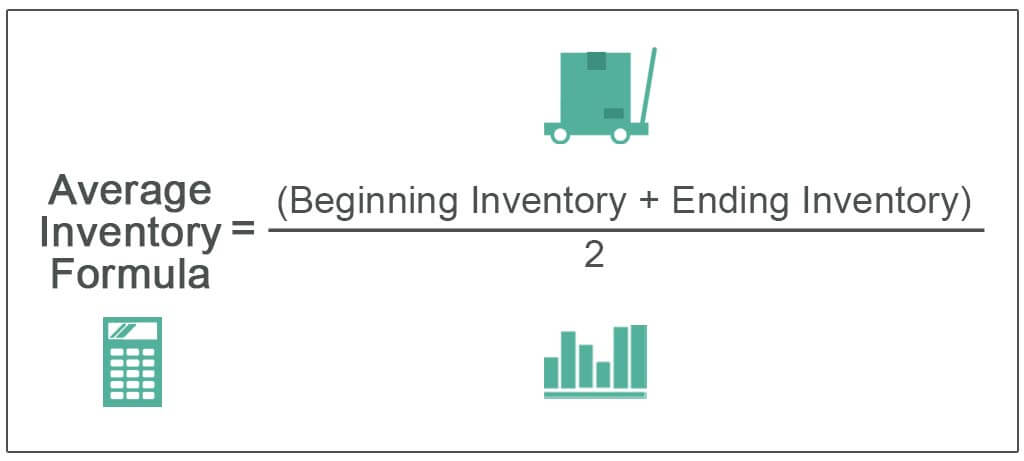

Average cost is the total amount of all production costs divided by the quantity of output produced. Calculator 13Average Down Calculator. For example if you buy 100 shares of stock at 2495 per share and pay a 5 commission your cost basis for that purchase is 2500.

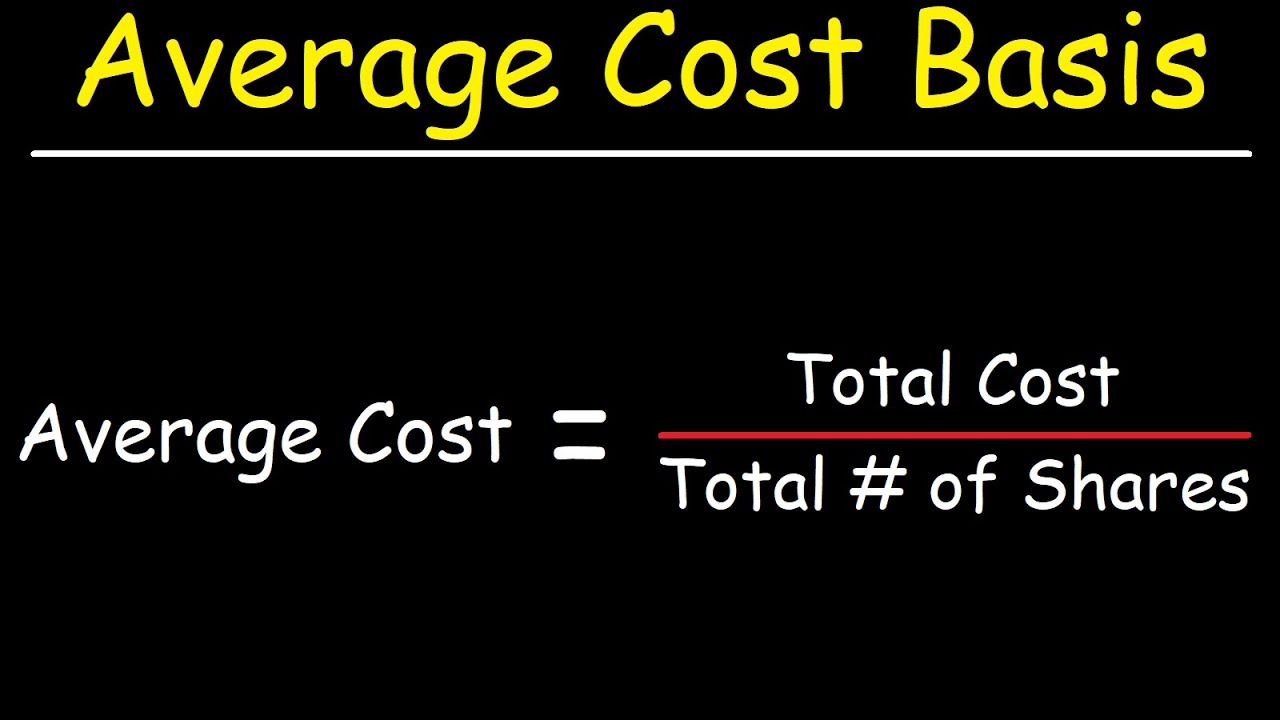

Enter the commission fees for buying and selling stocks. Enter the purchase price per share the selling price per share. Average Cost Basis Calculator.

Averaging down the stock is done by purchasing more shares at a lower price than the previous price which provides lower costs per share if the process is repeated. Just follow the 5 easy steps below. Download Average Down Calculator as an Excel File for free.

Following is an average down stock formula that shows you how to calculate average price. Exchanges are also supported. Stock exchange and supported by Alpha Vantage.

One way to reduce your paper losses in the stock market is to lower your average price per share or simply to do cost averaging down. The difference between net proceeds of the sale and the cost basis in this example indicates a gain of. The main advantage of averaging down is that an investor can bring down the average cost of a stock holding substantially.

To calculate the average cost divide the total purchase amount 2750 by the number of shares purchased 5661 to figure the average cost per share 4858. In this example dollar-cost averaging paid off by netting a much lower average purchase price than the initial investment. Some stocks traded on non-US.

Stay tuned also for the mobile app version of this calculator. Say you decide to get into the DRP of the company Acme Elevator Inc. Averaging down is an investment strategy that involves buying more of a stock after its price declines which lowers its average cost.

Calculate New Stock Average. Cost Basis Average cost per share 4858 x of shares sold 5 24290. Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional.

Your average cost per share is usually lower than if you were to buy all the shares at once. Lets say you buy 100 shares at 60 per share but the stock drops to 30 per share. You can determine the ATC with a simple equation.

Get stock average calculator for Play Store. Calculate Your Total Cost. Your net average cost per share is therefore 25.

The lower of cost or market LCM method states that when valuing a companys inventory it is recorded on the balance sheet at either the historical cost or the market value. Assuming the stock turns around this ensures a lower breakeven point. Enter the number of shares purchased.

In this example multiply 100 by 10 to get 1000 multiply 200 by 7 to get 1400 and multiply 250 by 850 to get 2125. I own 100 shares of ABC stock at an avg. Then you got profit Otherwise you got the loss.

Dont include sales because you are caliculating the amount you spent to buy stock.

Average Inventory Formula How To Calculate With Examples

How To Calculate Weighted Average Price Per Share Fox Business

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Stock Average Calculator Cost Basis

How To Calculate Your Average Cost Basis When Investing In Stocks Youtube

Cost Of Preferred Stock Rp Formula And Excel Calculator

Average Formula How To Calculate Average Calculator Excel Template

Cost Of Goods Sold Formula Calculator Excel Template

Stock Average Calculator Cost Basis

Weighted Average Formula Calculator Excel Template

Average Total Cost Formula Step By Step Calculation

Step 2 Calculate The Cost Of Equity Stock Analysis Cost Of Capital Step Guide

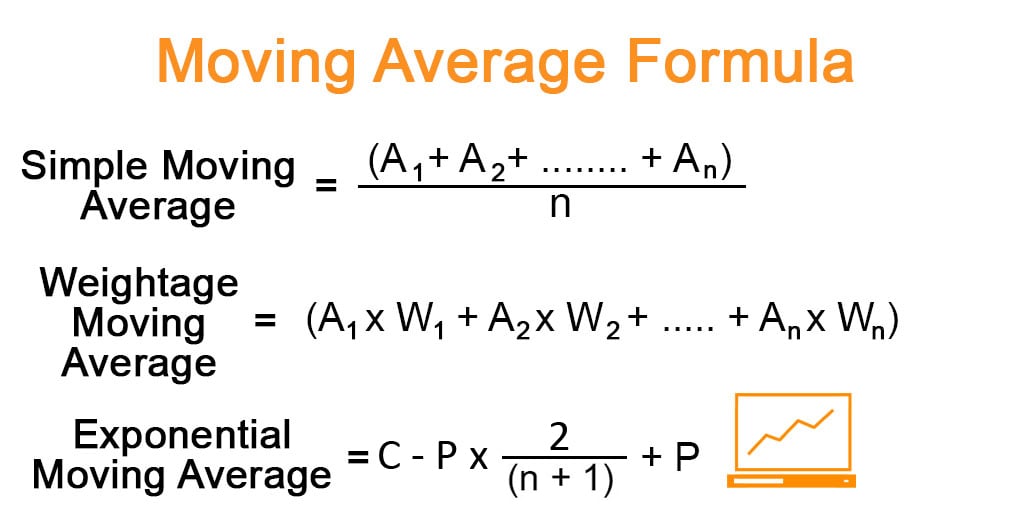

Moving Average Formula Calculator Examples With Excel Template

/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)

:max_bytes(150000):strip_icc()/BareYTMFormula-749dc18525fe43e78b7e45100c7339b9.jpg)