r&d tax credit calculation example uk

You are able to go back up to two years to submit your RD claim to HMRC. Deduct the RD enhanced expenditure within the tax computation.

Woman Doing Accounting At Home In 2022 Accounting Services Accounting Business Tax

Select either an SME or Large.

. Just follow the simple steps below. The RD tax relief would enable a profitable SME to reduce the amount of corporation tax they pay on profits for the period by the amount of the enhanced deduction. Average calculated RD claim is 56000.

Home RD Tax Credits Calculator. The RD Tax Relief scheme allows a further deduction to be made calculated as 130 of the qualifying expenditure identified. If you dont have all.

Free RD Tax Credits Calculator and a Team of Experts to help you through the RD claim process. Our free RD Tax Credit Calculator instantly crunches your numbers and shows how much in RD Tax Credits your business could claim from HMRC. 100k QE in this example.

RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes. It was increased to. The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017.

Call 01332 819 740. RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs over a base amount. RD Tax Credit Calculation Examples.

Use our RD tax credits calculator to get an indication of the cash benefit you can receive from claiming RD tax relief. This credit appears in the Internal Revenue Code section 41 and is. First however the fix-based percentage must be obtained by.

The notional additional 130 RD tax deduction is deducted within the company tax computation. The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable as trading income. The calculation of your RD tax relief benefit depends on the companys situation whether it falls into the category of-.

Free RD Tax Calculator. Calculate how much RD tax relief your business could claim back.

How To File A R D Research And Development Tax Credit Claim Easy Digital Filing

Claiming R D Tax Credits For Your Manufacturing Business

How To File A R D Research And Development Tax Credit Claim Easy Digital Filing

It Major Incident Report Template 5 Templates Example

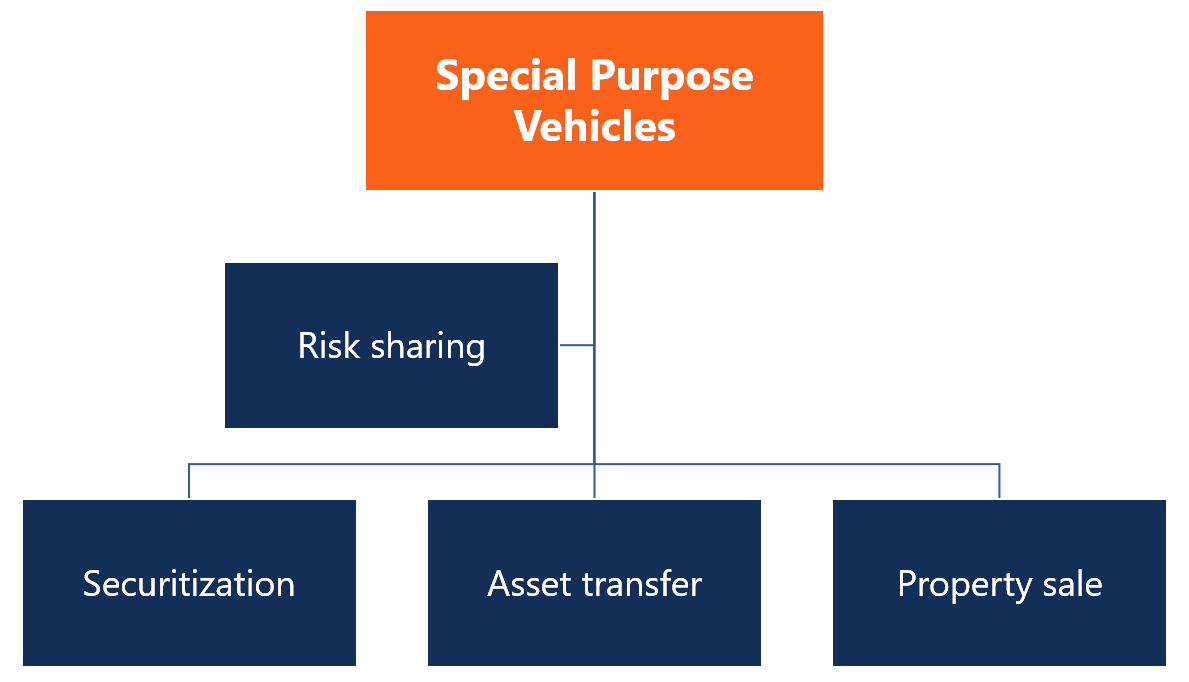

Special Purpose Vehicle Spv Guide Examples What You Need To Know

Should My Client Surrender Losses For An R D Tax Credit Whisperclaims

Ct600l Update On Presentational Issues For Brought Forward Amounts Tax Systems

How To File A R D Research And Development Tax Credit Claim Easy Digital Filing

R D Tax Credit Rates For Rdec Scheme Forrestbrown

How Pillar Two Attacks Multinationals High Tax Subsidiaries

Purchase Price Allocation Ppa Acquisition Accounting Process

How Pillar Two Attacks Multinationals High Tax Subsidiaries

How To File A R D Research And Development Tax Credit Claim Easy Digital Filing

R D Advance Funding Early Access To Your R D Tax Credit Mpa

How To File A R D Research And Development Tax Credit Claim Easy Digital Filing

Irc Section 1202 Exclusion Of Gain From Qualified Small Business Stock

How Should R D Tax Credits Be Treated Within Company Accounts Counting King

How Should R D Tax Credits Be Treated Within Company Accounts Counting King